![Se i Social network fossero sempre esistiti - 📖 Inferno, Canto I (estratto da "La Divina Commedia Riveduta e Scorretta") [...]Come sappiamo (locuzione che di solito introduce quello che non si sa Se i Social network fossero sempre esistiti - 📖 Inferno, Canto I (estratto da "La Divina Commedia Riveduta e Scorretta") [...]Come sappiamo (locuzione che di solito introduce quello che non si sa](https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2769222223346134)

Se i Social network fossero sempre esistiti - 📖 Inferno, Canto I (estratto da "La Divina Commedia Riveduta e Scorretta") [...]Come sappiamo (locuzione che di solito introduce quello che non si sa

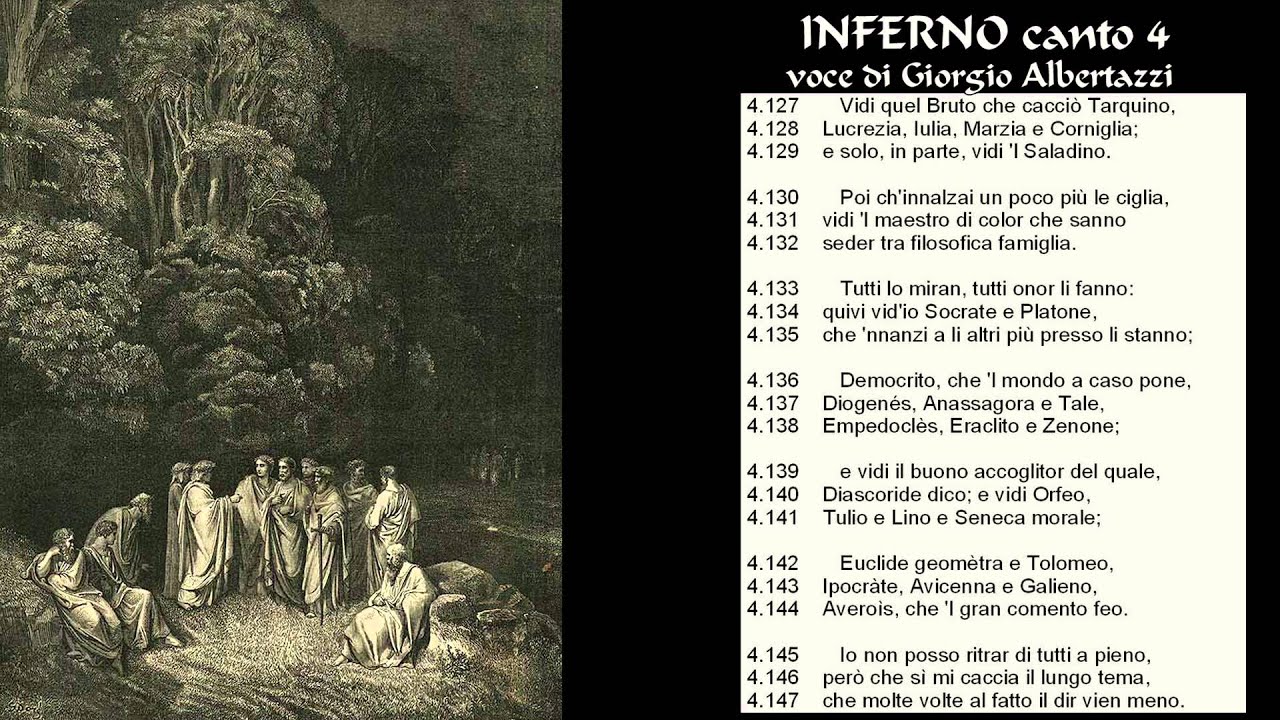

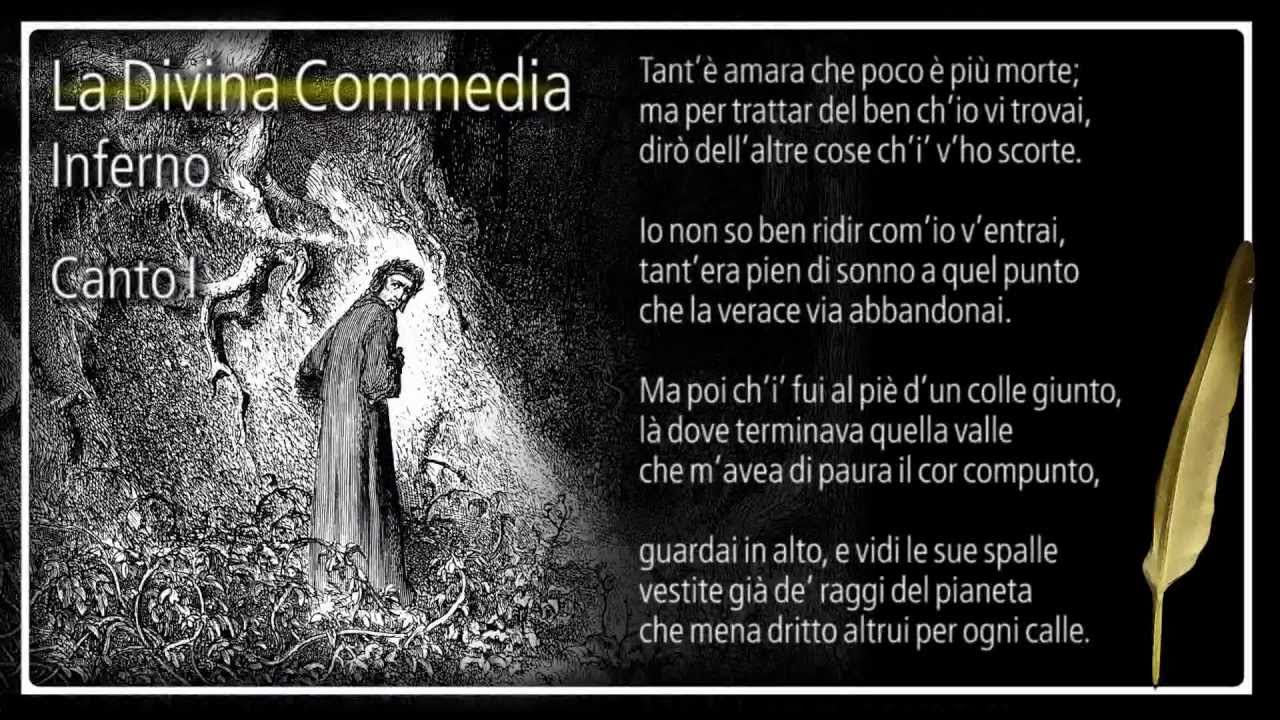

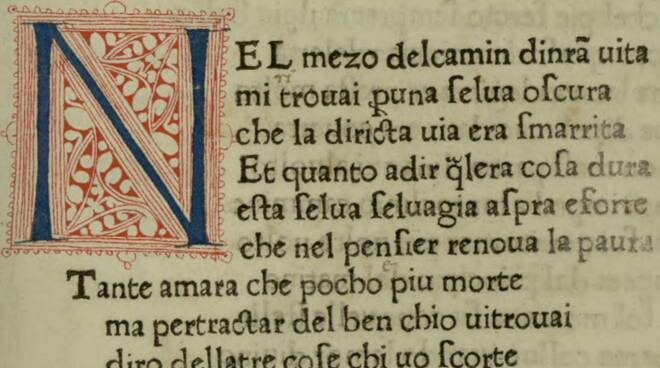

Parafrasi + Commento del I canto dell'inferno della Divina Commedia, per esame di Introduzione a Dante del docente Bellomo Saverio

L'ora che volge il disìo”. Lettura perpetua della Divina Commedia. De Pascale legge il Primo canto dell'Inferno - RavennaNotizie.it

![Se i Social network fossero sempre esistiti - 📖 Inferno, Canto II (estratto da "La Divina Commedia Riveduta e Scorretta") [...] Dopo l'invocazione alle Muse, Dante riprende ad ammorbare Virgilio con le Se i Social network fossero sempre esistiti - 📖 Inferno, Canto II (estratto da "La Divina Commedia Riveduta e Scorretta") [...] Dopo l'invocazione alle Muse, Dante riprende ad ammorbare Virgilio con le](https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=2773967812871575)

![Del primo canto della Divina Commedia di Dante: comenti [with text.] (1840 edition) | Open Library Del primo canto della Divina Commedia di Dante: comenti [with text.] (1840 edition) | Open Library](https://covers.openlibrary.org/b/id/6215372-L.jpg)